Insight & Resources

Insights from WWF-Singapore’s Pilot Study

Our pilot study with a small group of private banks revealed several key observations:

01

Make sustainability a strategic priority: Private banks need to integrate sustainability at all levels, including setting science-based targets and increasing their focus on climate and nature-related risks

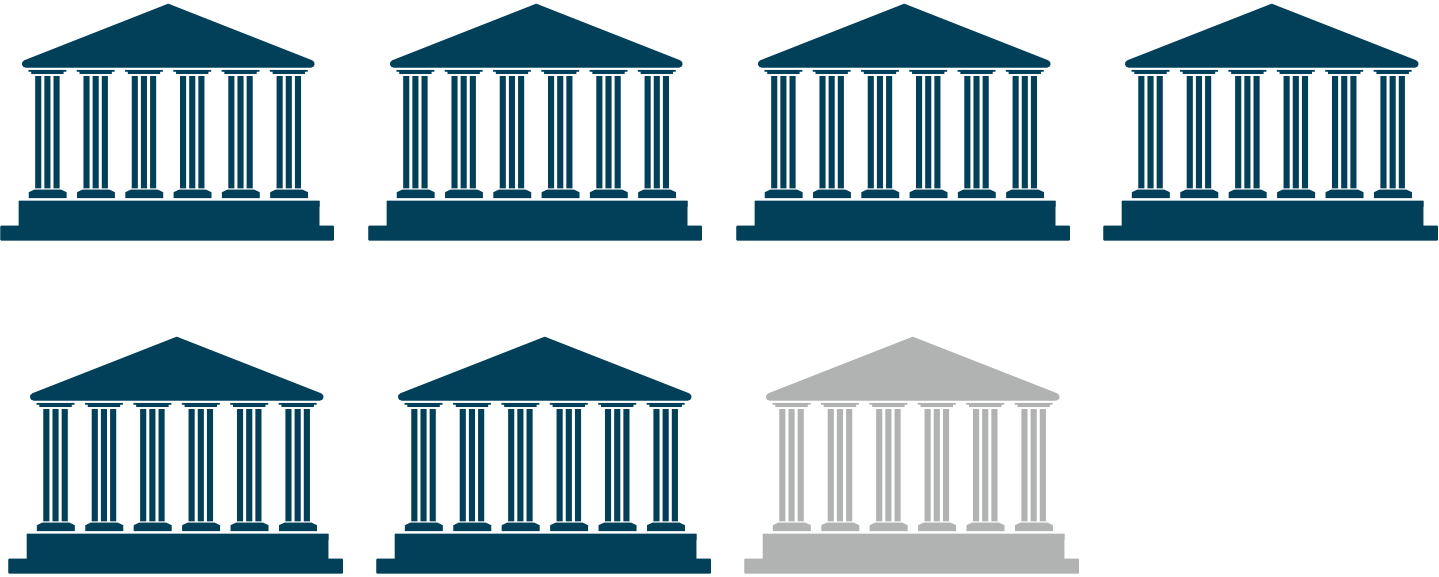

ALL SEVEN PRIVATE BANKS HAVE MADE PUBLIC COMMITMENTS IN LINE WITH THE OBJECTIVES OF THE PARIS AGREEMENT TO LIMIT GLOBAL WARMING TO 1.5°C AT THE GROUP LEVEL.

5 OUT OF 7 PRIVATE BANKS REFERENCE OR MAP THEIR STRATEGY AND ACTIVITIES TO THE UNITED NATIONS SUSTAINABLE DEVELOPMENT GOALS (SDGS).

FURTHER, 4 OUT OF 7 PRIVATE BANKS HAVE YET TO SET THEIR SCIENCE-BASED TARGETS FOR DECARBONISATION, WHILE THREE PRIVATE BANKS HAVE DONE SO.

02

Strengthen risk management and governance structures: ESG oversight should be an integral part of private banks’ processes, with due diligence and scenario analysis conducted regularly.

RISK MANAGEMENT

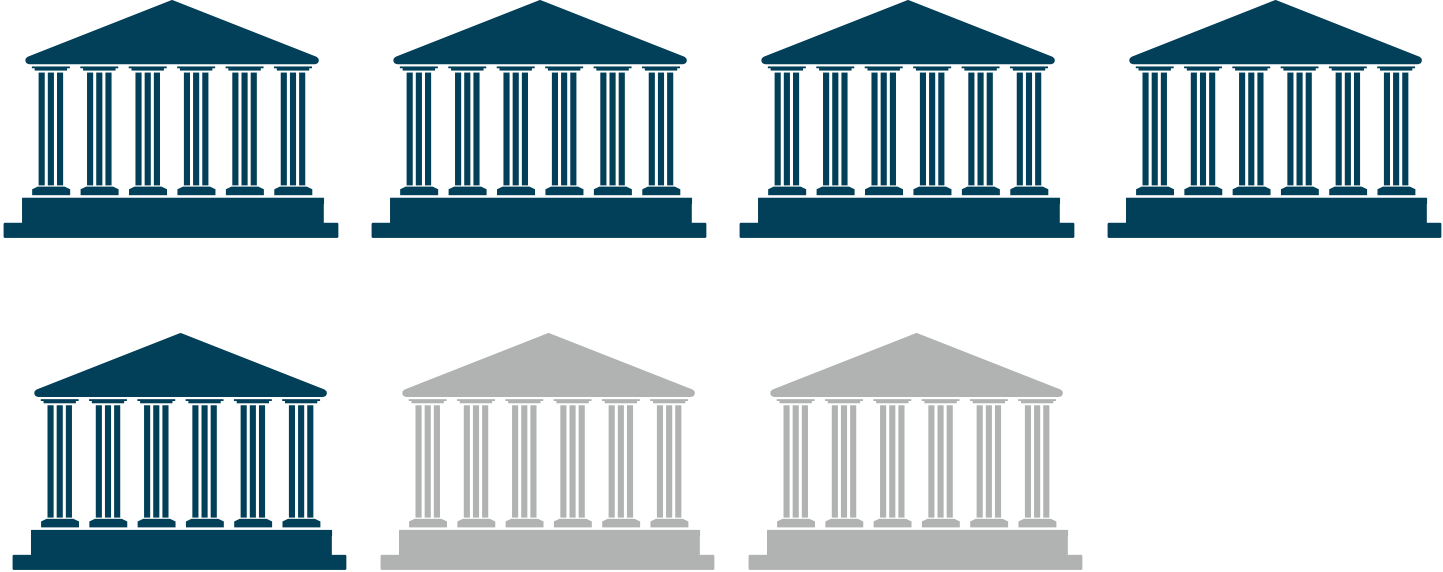

4 of 7 private banks reported that they continually check their portfolios for environmental and social risk events, such as deforestation and violations of human rights,

- Two do not currently do so, and one is setting up the monitoring procedures.

- Additionally, 4 out of 7 private banks indicated that they have a strategy to manage and mitigate climate-related risks across their portfolios.

FORWARD-LOOKING RISK ANALYSIS

5 out of the 7 banks are using forward-looking risk analysis methods, such as scenario analysis, to review their ESG risk profiles.

- The scope of scenario analysis varies across the banks, with two focused on discretionary portfolio management (DPM), investment advisory, and wealth planning.

- Three others are conducting analysis at the group level, excluding wealth management and/or focused on the credit book.

DATA FOR DUE DILIGENCE

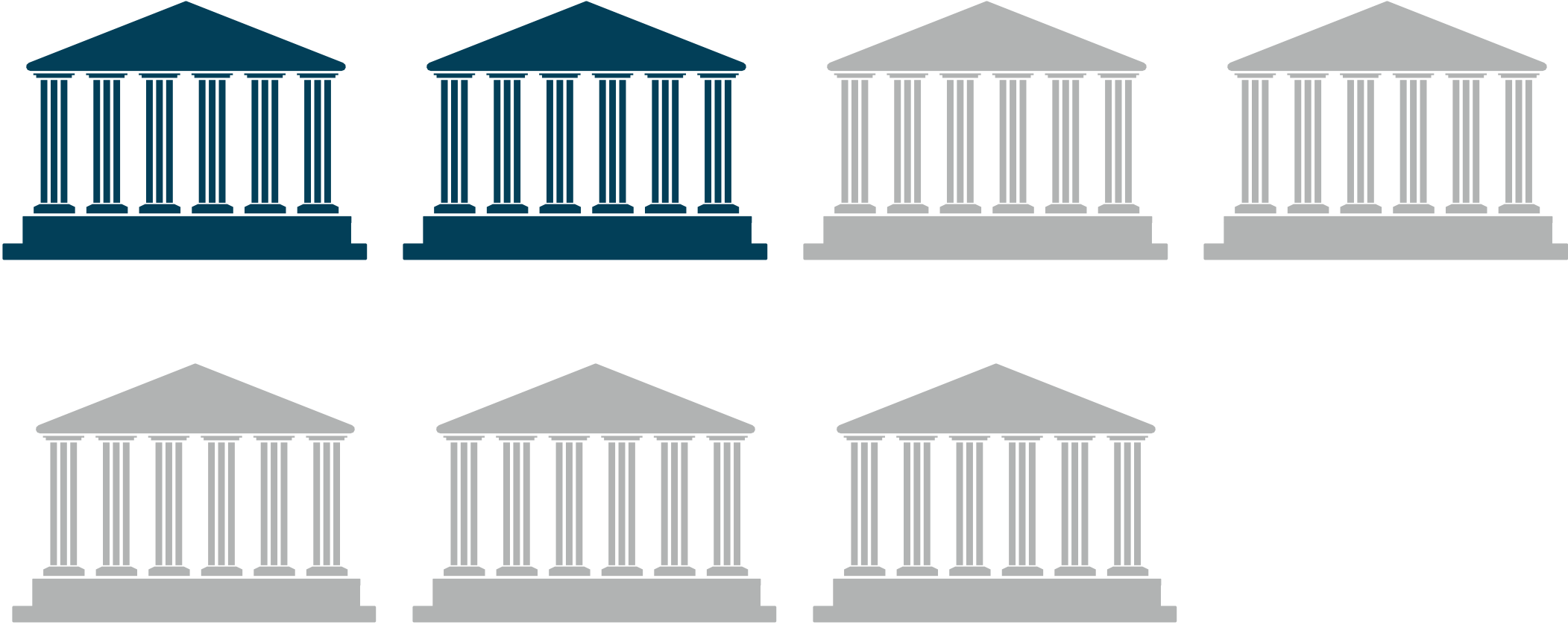

- All of the banks surveyed are using at least one data type for ESG investment due diligence in their private banking activities, while 5 out of 7 banks use two or more data types.

- Raw data from external provider: 4

- External ESG rating: 4

- In-house ESG analysis/ESG scoring methodology: 3

03

Prioritise ESG considerations in client due diligence and the customer journey: Understanding clients’ ESG preferences can help banks mitigate risks and identify sustainable investment opportunities.

GOVERNANCE

All seven private banks have board-level responsibility for the implementation of the bank’s ESG strategy.

- Only one bank has a dedicated sustainability officer in private

banking.

- The remaining six are being led by a group chief sustainability officer.

- All private banks in the study have established the fundamental requirement of an internal control system with three lines of defence to manage environmental and social (E&S) issues.

BOARD APPOINTMENT

3 out of 7 banks include the terms of reference of the board’s audit committee or the criteria used to cover a requirement to consider sustainability.

- 1 out of 7 banks include the terms of reference of the board’s nominating committee or the criteria used in appointing new directors cover a requirement to consider sustainability.

BOARD DIVERSITY

6 out of 7 banks have the commitment to increase diversity at the board/senior management level, and/or for portfolio managers/investment teams, primarily in terms of race and gender.

Majority (5) of the private banks in the study do not include ESG factors as a part of client onboarding and regular client profile review processes.

In addition, five banks do not proactively inquire about the sustainability preferences of their existing clients when providing investment services or conducting client reviews.

04

Link executive compensation to sustainability goals: Sustainability-linked remuneration can drive progress towards sustainability objectives and foster a culture of long-term value creation.

05

Develop engagement and voting strategies to meet client preferences: Private banks can support clients by advocating for better business practices among investee companies and exercising delegated voting and engagement rights.

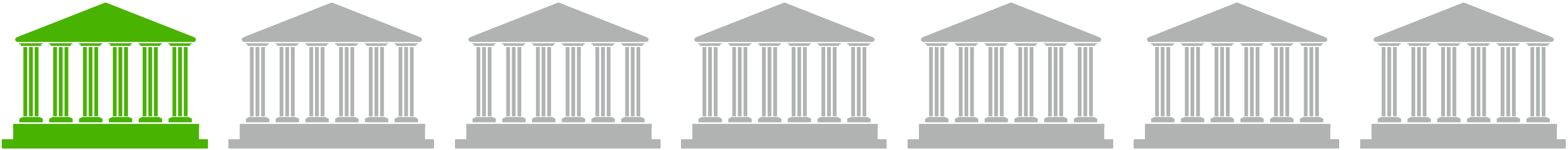

ONLY 1 OUT OF THE 7 BANKS VOTES ON THEIR CLIENT’S BEHALF FOR DPM, ADVISORY AND CUSTODIAL MANDATES.

NONE OF THE PRIVATE BANKS PARTICIPATED/DISCLOSED IN ANY COLLECTIVE ENGAGEMENTS ON ESG ISSUES.

NONE OF THE PRIVATE BANKS HAVE A PROCESS OR GUIDELINES THAT DEMONSTRATE HOW THE BANK PRIORITISES ISSUES AND COMPANIES FOR ENGAGEMENT OR MECHANISMS FOR ESCALATION IF ENGAGEMENT FAILS (E.G., SHAREHOLDER RESOLUTIONS, DIVESTMENT).