About

The SUSBA interactive toolkit enables assessment and benchmarking of critical

Environmental & Social integration performance for banks across the globe.

offset

OBJECTIVES OF SUSBA

- Highlight the potential for the financial sector to drive sustainable development in Asia Pacific and beyond.

- Provide a decision-useful assessment framework that incorporates environmental and social issues most relevant to the Asia Pacific region.

- Help stakeholders assess banks’ management of climate risk amid strong global support for the Task Force on Climate-Related Financial Disclosures (TCFD) framework, UNEPFI Principles for Responsible Banking (PRB), and other initiatives.

- Help shareholders, potential investors, regulators and civil society representatives to track banks’ progress and performance on ESG integration by displaying the evolution of results year-on-year.

- Present the results in an online interactive platform that allows users to compare selected banks and indicators based on their preferences.

offset

METHODOLOGY: ENVIRONMENTAL & SOCIAL

ASSESSMENT FRAMEWORK

SCOPE

INFORMATION USED

ASSESSMENT FRAMEWORK

The SUSBA tool assesses the public disclosures of 36 listed banks across six ASEAN countries (Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam), 10 major banks in Japan and Korea, and an additional eight international banks active in the region.

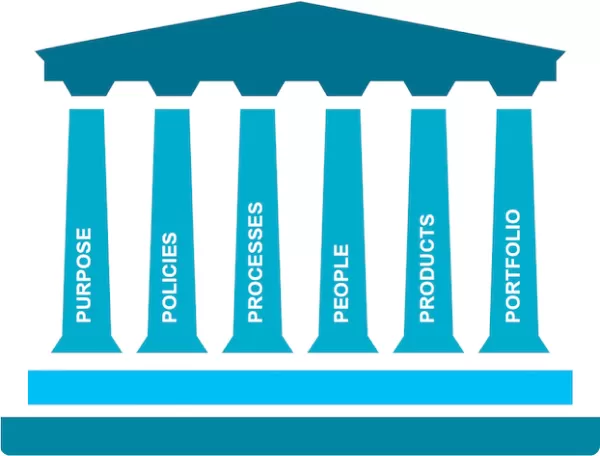

The assessment framework comprises six pillars and 11 indicators, that signify what WWF considers to be robust ESG integration. The assessment is performed against 76 sub-indicators, with binary “yes/no” answers.

We developed this framework with reference to:

- Existing international frameworks, standards and initiatives, including:

- GRI Sustainability Reporting Guidelines,

- International Integrated Reporting Council (IIRC)’s International

- Integrated Reporting Framework

TCFD recommendations - Sustainability Accounting Standards Board (SASB)

- Relevant national principles and guidelines on sustainability reporting.

- Specific environmental and social issues most relevant to Asia Pacific.

- Deep science-based insights rooted in our global network of sustainability experts.

To provide a more comprehensive data set against which Asia Pacific banks can benchmark themselves, the tool includes assessments of select international banks that are active in the Asia Pacific loan market. Although SUSBA remains an Asia-focussed tool, banks in the region may find it useful to compare themselves against international banks that began their ESG integration journey earlier.

To highlight the progress that banks have made on ESG integration, the assessment results also display improvements or regressions (indicated in green and red, respectively). To view the detailed assessment results and benefit from the tool’s full functionalities, users can visit our Assessment page.

SCOPE

The assessment of ESG integration focuses only on the banks’ indirect footprint, i.e. its exposure to ESG risks and impacts through client relationships, as opposed to the bank’s direct footprint (e.g. building energy consumption, paper consumption, and staff travel). There is a broad consensus among various stakeholders (investors, regulators, civil society) that while the management of direct impacts is important, indirect risks and impacts are far more significant, and should form the backbone of any bank’s sustainability strategy.

The assessment focuses on the banks’ corporate/wholesale activities. Retail banking, private banking, and asset management divisions are excluded.

INFORMATION USED

Bank information reviewed for the assessment included only publicly available, English-language disclosures in the form of the relevant fiscal year annual reports, sustainability reports or corporate social responsibility reports, as well as information posted on corporate websites such as company policies, statements, investor presentations and press releases. These public disclosures represent what is available to international investors and stakeholders looking to develop an understanding of how banks are managing climate and ESG risks and opportunities so as to contribute to sustainable development. The banks were not interviewed and have not verified the information contained in this report

offset

METHODOLOGY: SECTORS & ISSUES

ASSESSMENT FRAMEWORK

SCOPE

INFORMATION USED

ASSESSMENT FRAMEWORK

The Sectors & Issues framework is a feature of SUSBA launched in 2020. The purpose of this framework is to guide banks on which commitments and disclosures they need to be making in order to address issues in key sectors for environmental and social factors.

The framework comprises two pillars. The first pillar assesses the bank’s public commitments and understanding of the E&S issues at hand. The second pillar is what the bank expects of clients operating in that sector. Banks can score 0, 0.5, or 1 on each sub-indicator. A score of 0.5 is given for incomplete or less robust performance. Below are the current sector frameworks SUSBA covers:

- Palm oil (38 indicators): Aligning with industry good practices such as RSPO certification and WWF’s Palm Oil Buyer Scorecards, the palm oil sector policy framework covers banks commitments within the sector (such as the bank’s specific sector approach, monitoring and disclosure) as well as the bank’s client expectation towards upstream producers (growers and mills), suppliers, third-parties and downstream manufacturers and retailers.

- Energy (33 indicators): The energy sector policy framework of SUSBA is designed to help banks start to make the transformation needed to align their portfolios with the constraints introduced by climate change. This primarily involves a rapid shift away from fossil fuels, starting with coal, while also safeguarding the most important ecosystems. The assessment framework covers bank commitments within the sector (such as the bank’s specific sector approach, monitoring and disclosure) as well as client expectations towards coal (extraction and refining, power generation), oil and gas, unconventional fossil fuels and crosscutting indicators aligning with international frameworks (e.g. TCFD disclosure, setting Science-based Targets).

- Seafood (33 indicators): The seafood policy framework of SUSBA was added in 2022. The sector’s growing importance as a key source of protein, paired with the growing ESG challenges it faces, positions it as a key source of both potential financial risk and opportunity. In addition to assessing the bank’s approach, monitoring and disclosure specific to the sector, the indicators related to client expectation were developed to align with UNEP FI Turning the Tide Guidance and are divided into Production (wild-capture), Production (aquaculture), Downstream (processors, value-add, distribution, brands) and Crosscutting (expectations on human rights commitments, adherence to international labour standards, approach to addressing social and community impacts, efforts to achieve supply chain traceability, etc.).

To view the detailed assessment results and specific indicators on sectors, users can visit the Assessment page to explore further.

SCOPE

The assessment of Sectors & Issues is consistent with SUSBA by focusing only on the banks’ indirect footprint, i.e. its exposure to E&S risks and impacts through client relationships, as opposed to the bank’s direct footprint (e.g. building energy consumption, paper consumption, and staff travel). There is a broad consensus among various stakeholders (investors, regulators, civil society) that while the management of direct impacts is important, indirect risks and impacts are far more significant, and should form the backbone of any bank’s sustainability strategy.

The assessment focuses on the banks’ corporate/wholesale activities. Retail banking, private banking, and asset management divisions are excluded.

INFORMATION USED

For consistency, the assessment only takes into account information that is disclosed publicly in English. This can take the form of annual reports or sustainability/corporate social responsibility reports, covering the relevant fiscal year, as well as information posted on corporate websites such as company policies, statements, investor presentations and press releases in that year . These public disclosures represent what is available to international investors and stakeholders looking to develop an understanding of how banks are managing E&S factors in specific sectors or for certain issues. Banks may reach out proactively to inform WWF about updates to banks’ disclosures. WWF will consider those and make necessary revisions, such that the assessments reflect their most updated state.

The information used was derived from a project funded by the International Climate Initiative (IKI).

offset

ABOUT WWF

WWF has worked with the financial sector (banks, investors and regulators) for more than a decade, with the objective of accelerating the integration of ESG risks and opportunities into mainstream finance, so as to redirect financial flows to support the Paris Agreement and the SDGs. Our approach to sustainable finance leverages:

Our conservation experience on the ground across WWF’s global practices.

Our partnerships with companies on key issues such as climate, energy, food and water to drive sustainability.

Our participation in cutting-edge sustainable finance initiatives (e.g. Science Based Targets initiative and the European Commission’s Technical Expert Group on Sustainable Finance).

This has allowed us to strengthen lending and investment criteria for key industry sectors, provide insights and data on environmental and social risks, fulfil critical research gaps, help unlock innovations in sustainable finance products and convene key stakeholders to progress the sustainable finance agenda.