About

RESPOND is an interactive toolkit that enables assessment and benchmarking of critical Environmental & Social integration performance for asset managers across the globe

“WWF’s RESPOND tool and framework offer useful reference points for comparing asset managers on their approaches to responsible investment and climate change. We believe RESPOND will help us to engage with asset managers, and that asset managers will use it to identify areas for improvement. We expect all the asset managers in the region will play key roles in sustainable finance by adapting best practices through RESPOND.”

Keiichi Nakajima, Former General Manager of MS&AD Insurance Group

“We expect our external asset managers to be integrating ESG analysis into investment decision-making. Included in this analysis is addressing natural capital risk exposure. WWF’s recently launched RESPOND framework and tool provide new perspectives into natural capital risk that can be used to help inform asset managers’ decision making.”

Brian Rice, Portfolio Manager at CalSTRS

offset

OBJECTIVES OF RESPOND

| Accelerate | Empower | Support |

| 1. Alignment of financial flows with sustainable development goals | 1. Asset managers to develop robust responsible investment capabilities to safeguard long term returns and consider the impacts of investments on real world outcomes | 1. Asset owners to better define expectations of asset managers aligned with science-based best practices |

| 2. The integration of environmental, social and governance considerations into the investment decision making process | 2. Financial sector to drive sustainable development in Asia Pacific and beyond. | 2. Stakeholders’ assessment of asset managers’ management of climate and nature risks |

offset

METHODOLOGY: ENVIRONMENTAL & SOCIAL

ASSESSMENT FRAMEWORK

SCOPE

INFORMATION USED

Asset managers assessed

ASSESSMENT FRAMEWORK

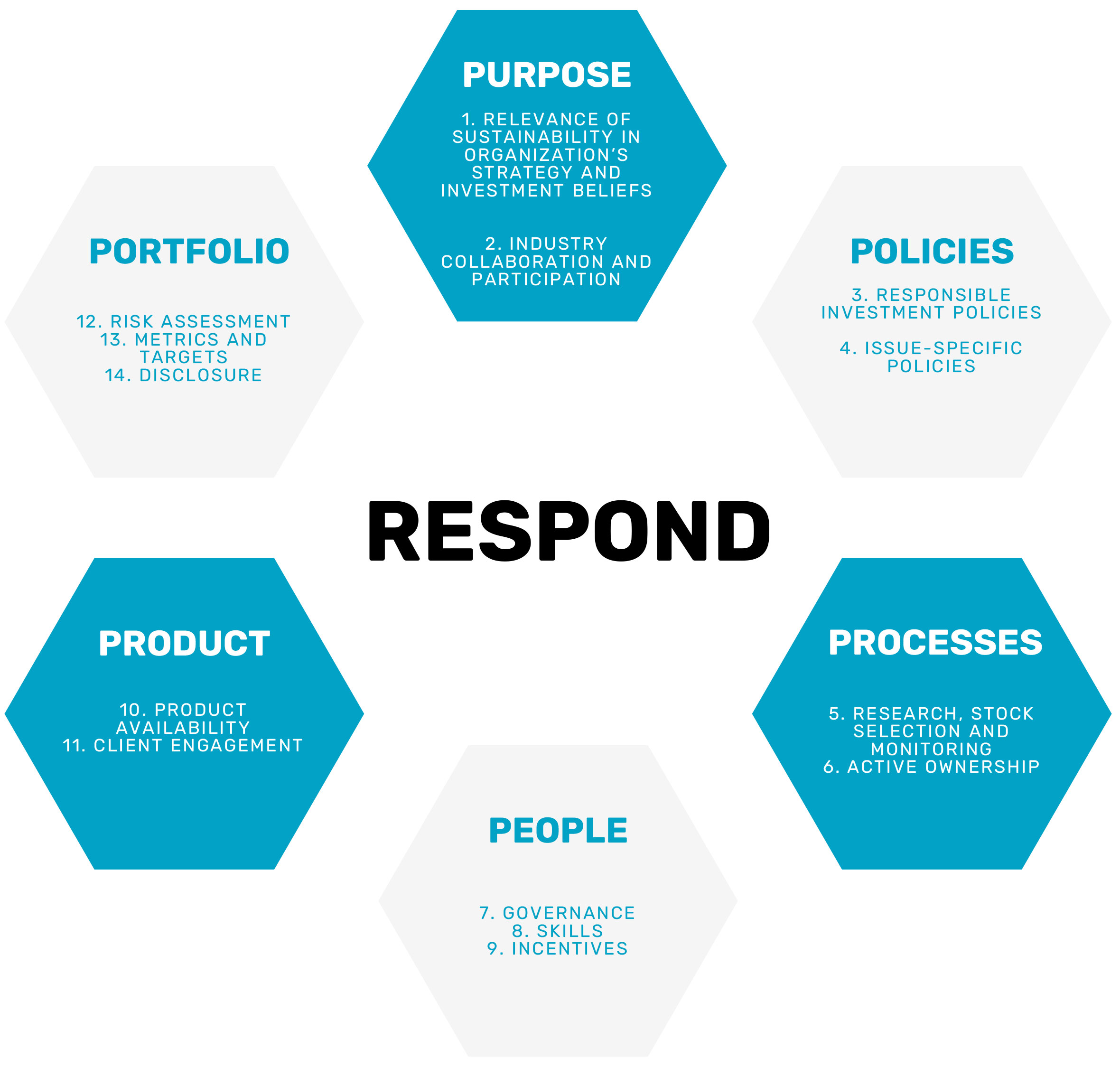

The framework encourages asset managers to go beyond existing market best practices to also incorporate WWF’s recommendations on science-based criteria and approaches for managing climate and other sustainability issues at both the issuer and overall portfolio levels. It aligns with TCFD and PRI and draws on national stewardship codes, reporting guidance, WWF’s conservation expertise, sustainability initiatives, and sustainable finance initiatives. The framework has 6 pillars, comprising of 14 indicators and 81 sub-indicators:

SCOPE

The RESPOND analysis for 2023 focused on 40 global asset managers that meet the following three criteria:

- Minimum assets under management (AUM) of US$200B for European asset managers and US$20B for Asian asset managers.

- Headquartered in Europe with offices in Asia or headquartered in Asia

- Signatories to the Principles for Responsible Investment (PRI)

RESPOND’s analysis exclusively examines asset managers’ indirect footprints, which refers to their exposure to ESG risks and impacts through their investee companies, rather than their direct (operational) footprints, such as building energy consumption, paper consumption, or staff travel.

Indirect risks and impacts are far more significant and should serve as the foundation of any asset manager’s sustainability strategy, even though the management of direct impacts is important.

While we acknowledge that corporate governance is essential to responsible investing (RI), RESPOND does not prioritize it as asset managers typically have significant experience addressing these issues. However, where relevant, the framework does examine the asset manager’s sustainability governance.

INFORMATION USED

RESPOND relies on publicly disclosed information in English by asset managers to evaluate their management of climate and ESG risks and opportunities for contributing to sustainable development.

The analysis includes the latest sustainability and RI reports (released by November 2022), as well as information posted on websites such as company policies, statements, investor presentations, and press releases. Additionally, the analysis takes into account the PRI 2021 Transparency Reports.

Asset managers assessed

- abrdn

- Aegon Asset Management

- Allianz Global Investors

- Amundi

- APG Asset Management

- Asset Management One Company Ltd.

- Aviva Investors

- AXA Investment Managers

- Baillie Gifford

- BNP Paribas Asset Management

- Bosera Funds

- China Asset Management Company Ltd.

- China Life Asset Management Company Ltd.

- China Southern Asset Management Company Ltd.

- DWS Group

- E Fund Management Company Ltd.

- Eastspring Investments

- Fidelity International

- Fullerton Fund Management Company Ltd.

- Harvest Fund Management

- HSBC Global Asset Management

- Kotak Mahindra Asset Management (Singapore) Pte. Ltd

- Legal & General Investment Management

- Lion Global Investors Ltd.

- M&G Investments

- Mitsubishi UFJ Trust and Banking Corporation

- Nikko Asset Management

- NN Investment Partners

- Nomura Asset Management

- Nordea Asset Management

- Ostrum Asset Management

- Pictet Asset Management

- Robeco

- SBI Funds Management Pte. Ltd.

- Schroders

- Sumitomo Mitsui Trust Asset Management

- UBS Asset Management

- Union Investment Group

- UOB Asset Management Ltd.

- UTI Asset Management Company Ltd

offset

METHODOLOGY: SECTORS & ISSUES

ASSESSMENT FRAMEWORK

SCOPE

INFORMATION USED

Asset managers assessed

ASSESSMENT FRAMEWORK

Energy Transition (ET) Framework

- Launched in 2023, the Energy Transition Framework provides a comprehensive tool for investors to assess the alignment of their energy sector investments with the need for a rapid transition to a low-carbon economy.

- The framework covers areas such as governance and strategy, risk management, and reporting across 6 Pillars, 9 indicators in total, with 28 sub-indicators used to assess the sustainability of investments in the energy sector.

Seafood Framework

- Launched in 2023, the Seafood Assessment framework provides a comprehensive assessment of asset managers’ approaches to addressing environmental and social (E&S) risks in seafood-related investments.Composed of two pillars: asset manager commitments and investee company expectations.

- The first pillar includes commitments from asset managers in three areas: sector approach, disclosure, and monitoring and engagement.

- The second pillar includes expectations for investee companies in four areas: production (wild-caught fisheries), production (aquaculture farms), downstream (processors, value-add, distribution, brands), and crosscutting.

- The framework includes 7 dimensions and 38 indicators to assess the sustainability of investments in the seafood industry.

SCOPE

Energy Transition (ET) Framework

The Energy Transition (ET) framework for 2023 focused on the same panel of 40 global asset managers assessed in the RESPOND framework, that meet the following three criteria:

- Minimum assets under management (AUM) of US$200B for European asset managers and US$20B for Asian asset managers.

- Headquartered in Europe with offices in Asia or headquartered in Asia

- Signatories to the Principles for Responsible Investment (PRI)

Seafood Framework

For the baseline seafood sector assessment, 42 leading investors in key seafood companies were assessed against the framework. Institutional asset managers were selected for inclusion after their seafood-related investment portfolios were analyzed in early 2022. A preliminary list of asset managers was developed to include those whose seafood-related investments put them in the top 50% or top 30 asset managers in each of the following seafood value-chain segments:

- Seafood production (wild catch and aquaculture)

- Midstream (processors, value-add)

- Downstream (brands, retail)

This preliminary list of asset managers was then refined to ensure full, and relatively equal, value-chain coverage, and to oversample for Asia-based investors given the region’s importance with regard to fisheries production and aquaculture.

INFORMATION USED

The publicly disclosed documents upon which these assessments are performed – annual reports, sustainability reports, ESG policies, corporate websites, etc. represent the base of information that international asset owners and other stakeholders have available to understand how asset managers are managing climate and ESG risks and opportunities. Each year, the asset managers included in these analyses are contacted and given the opportunity to review their preliminary results and provide feedback.

Asset managers can always reach out proactively to inform WWF-Singapore about any updates to their public ESG disclosures. If such updates are received, WWF-Singapore will consider them and make necessary revisions to the RESPOND analyses to reflect the most up-to-date information available.

Asset managers assessed

Energy Transition (ET) Framework

- abrdn

- Aegon Asset Management

- Allianz Global Investors

- Amundi

- APG Asset Management

- Asset Management One Company Ltd.

- Aviva Investors

- AXA Investment Managers

- Baillie Gifford

- BNP Paribas Asset Management

- Bosera Funds

- China Asset Management Company Ltd.

- China Life Asset Management Company Ltd.

- China Southern Asset Management Company Ltd.

- DWS Group

- E Fund Management Company Ltd.

- Eastspring Investments

- Fidelity International

- Fullerton Fund Management Company Ltd.

- Harvest Fund Management

- HSBC Global Asset Management

- Kotak Mahindra Asset Management (Singapore) Pte. Ltd

- Legal & General Investment Management

- Lion Global Investors Ltd.

- M&G Investments

- Mitsubishi UFJ Trust and Banking Corporation

- Nikko Asset Management

- NN Investment Partners

- Nomura Asset Management

- Nordea Asset Management

- Ostrum Asset Management

- Pictet Asset Management

- Robeco

- SBI Funds Management Pte. Ltd.

- Schroders

- Sumitomo Mitsui Trust Asset Management

- UBS Asset Management

- Union Investment Group

- UOB Asset Management Ltd.

- UTI Asset Management Company Ltd

- AllianceBernstein L.P.

- Berkshire Hathaway Inc.

- BlackRock

- Capital Group

- Charles Schwab Investment Management, Inc.

- Fidelity Investments

- Fisher Investments

- Geode Capital Management, L.L.C.

- Invesco Advisers, Inc.

- Jennison Associates LLC

- JP Morgan Asset Management

- MFS Investment Management

- Morgan Stanley Investment Management Inc. (US)

- Northern Trust

- Nuveen LLC

- State Street Global Advisors (US)

- Rowe Price Associates, Inc.

- The Vanguard Group, Inc.

- Wellington Management Company, LLP

- Asset Management One Co., Ltd.

- CP Worldwide Investment Company Limited

- Daiwa Asset Management Co., Ltd.

- GIC Private Limited

- Meiji Yasuda Life Insurance Company

- Mitsubishi UFJ Kokusai Asset Management Co., Ltd.

- Mitsui Sumitomo Insurance Co Ltd

- Nikko Asset Management Co., Ltd.

- Nippon Life Insurance Company

- Nomura Asset Management Co., Ltd.

- Social Security Office

- Sompo Japan Insurance Inc

- SPARX Asset Management Co., Ltd.

- Sumitomo Life Insurance Co.

- Sumitomo Mitsui Trust Asset Management Co., Ltd.

- The Dai-ichi Life Insurance Company, Limited

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Tokio Marine Asset Management International Pte. Ltd

- Norges Bank Investment Management (NBIM)

- Schroder Investment Management

- Baillie Gifford & Co.

- Legal & General Investment Management Ltd.

- Janus Henderson Investor

offset

ABOUT WWF

WWF has worked with the financial sector (banks, investors and regulators) for more than a decade, with the objective of accelerating the integration of ESG risks and opportunities into mainstream finance, so as to redirect financial flows to support the Paris Agreement and the SDGs. Our approach to sustainable finance leverages:

Our conservation experience on the ground across WWF’s global practices.

Our partnerships with companies on key issues such as climate, energy, food and water to drive sustainability.

Our participation in cutting-edge sustainable finance initiatives (e.g. Science Based Targets initiative and the European Commission’s Technical Expert Group on Sustainable Finance).

This has allowed us to strengthen lending and investment criteria for key industry sectors, provide insights and data on environmental and social risks, fulfil critical research gaps, help unlock innovations in sustainable finance products and convene key stakeholders to progress the sustainable finance agenda.